Auto Loans for Students: Avoiding Rejections

With the current economic situation, autos are becoming costly. Most of the people find it difficult to buy a fresh automobile even whether they have well-paid for work opportunities. That’s as a result of large rise in the of crucial everything. Pupils who make an application for auto loans confront returns. A large number of returns are made by conventional banking institutions and also other equivalent businesses. This doesn’t suggest that you’ll lose hope and experience disappointed. There is no part of complaining find an efficient remedy as an alternative. This information will support individuals stay away from denials when obtaining car or truck lending options. How? Nicely, to get the solutions, you’ll want to look at this article.

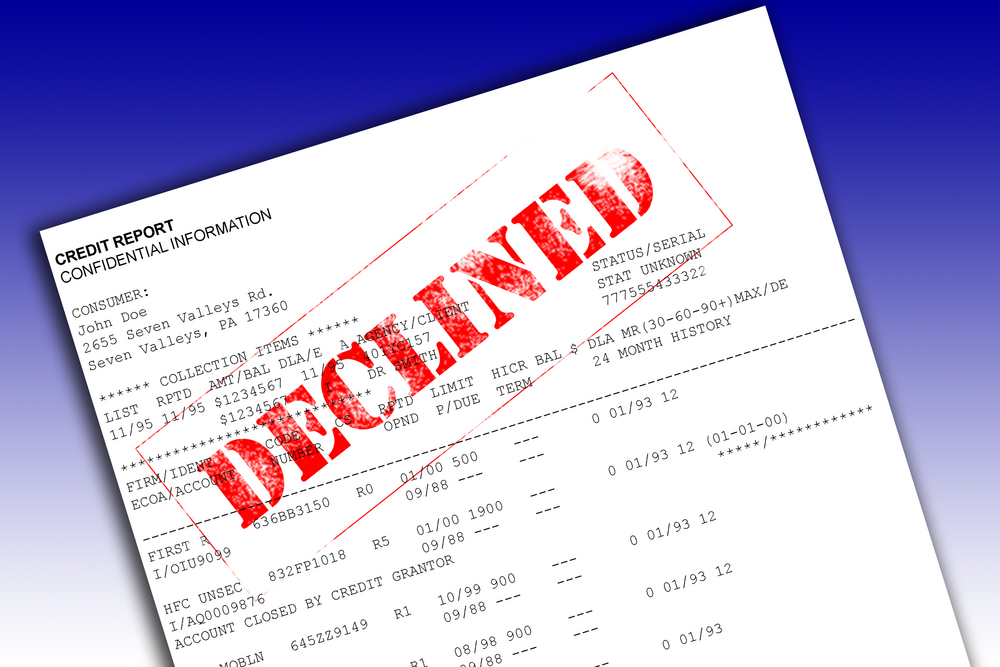

Prior to talking over about how to steer clear of rejections, we will discover the basis for disapproval. An undesirable or no credit history at all is the main cause of returns. Creditors are not able to determine whether or not students has settlement abilities or otherwise.

Much less Credit card debt-to-Cash flow (DTI) Rate

What exactly is designed by DTI? This really displays your monthly borrowings when compared with your month-to-month revenue. If the DTI of your student is significantly less, it implies that she or he has reduced bad debts. So, when you have less DTI, loan companies will sanction the application as it is possible to make monthly premiums by the due date. So, in order to avoid rejections, make sure that your DTI is under 40 %.

Way to obtain Normal Revenue

Almost all of the new or used car and truck loans companies will eliminate an undesirable or zero credit standing offered you do have a method to obtain standard cash flow. Since you’re trainees, an element-time job will be deemed by these loan company. For these kinds of lenders comprehend trainees has very limited time and can’t do a entire-time job. Nevertheless, you have to have sufficient regular monthly cash flow to create appropriate and continuous obligations. The easiest method to persuade on the web lenders is simply by redecorating your latest shell out statement.

Retain 10-15 % of Advance Payment Income Set

The total amount borrowed may be decreased if you are ready with at the very least 10-15 % with the down payment funds. You’ll be able to shell out far more if you possess the money but 10-15Percent is a good total to have straightforward approvals. And, whenever you make a excellent preliminary settlement, the financial institution will know that there is a secure finances.

Additionally it is vital to have any conviction expertise. You should encourage that you have a once a month cash flow and you will probably not fall short when it comes to making payments. Of course, you will need to live up to your offer.

Obtain a Denver colorado-Signer

Before you sign a final contract, it can be prudent to get a company-signer as loan providers believe in a customer with a co-signer. A company-signer will be your mother and father, your brother or sister, or a good friend who will pay off the obligations, in case you are unsuccessful. You can pay off the amount in your parents or even a pal according to your benefit.

Over a last note, it can be declared that the conditions and terms from the car finance are very important. Before applying for automobile loans, carefully glance at the stipulations to prevent issues. For some loan providers may well cost larger interest levels. So, look when you bounce.