Another Addition To the Education Tab: Pre-College Costs

We all know that the expenses that make up the college experience are high… high enough to induce a national student loan debt crisis. But educational spending often starts long before the actual tuition bill arrives. Pre-college costs are not just about buying twin-size bedsheets for the dorm room or a cheap bike for scooting around campus anymore. Parents (and some students) are now pouring money into another funnel: the pre-college standardized testing industry.

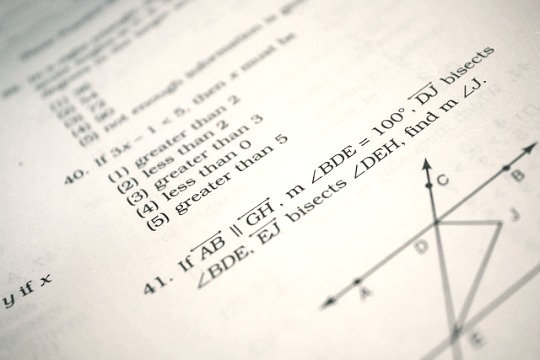

SAT scores have long been an essential component of the college application process, but the increasing competitiveness for college acceptance letters is fueling the growth of the paid prep industry. Students now feel pressure to purchase test prep courses, specialized studying materials, and even one-on-one tutoring, all of which require their families to spend hundreds of dollars (or more) before there’s even one college acceptance letter to show for it.

A recent interview with NPR gave high school student Ben Tonelli the floor to speak his mind about these expenses, and as you can imagine, the high costs came under heavy criticism. You can read the transcript of the full interview, which was Inspired by his original op-ed in the Wall Street Journal.

So for those currently applying for college and looking ahead to the costs of test prep, how can navigate this tricky terrain? Below, we’ll offer some tips on how you can avoid unexpected financial hardship by creating a plan for covering these pre-college costs.

Talk to your school counselor or college official

Your counselor may be in the know when it comes to even more ways to cut costs or lower/waive fees. Your school may offer scholarships or fundraising alternatives to help you pursue your classes without feeling financially strained. It never hurts to inquire, and you’ll help to forge a relationship with your counselor at the same time!

Recycle educational materials

Yes, SAT study materials are updated every year but that’s not to say that you can’t get much of the same valuable help from versions of a few years past. Most of these updates are minimal and your success likely doesn’t hinge on whether you’ve studied from the 2013 version or the 2014 version. Fortunately, most older versions are sold at extreme discounts after the test-taking season, which presents an opportunity to save even more.

Be calculated in your decisions

In addition to these pre-college testing costs, there’s also a serious price tag attached to each college application that you send out. The priciest application fee comes in at $90 (for Stanford) and the average hovers around $65. Multiply that by 10 and you have quite the sum on your hands. While it’s true that you should extend your application reach to an array of schools, that doesn’t necessarily mean applying to dozens of schools just for the sake of applying. Instead, write out the schools you wish to apply to, and then start asking the hard questions. Keep elements like price, location, and specialty in mind as you make your decisions. Also remember that some schools may be able to waive the application fee if you and your family are unable to pay it.

College is a commitment – both mentally and financially. If you’re worried about the cost even before you take a look at the tuition, then avoid financial surprises by allowing for proper planning aimed at easing the financial stress!

They keep changing the test, I don’t know how long you can pass the study books down anymore. Thank goodness for all the resources on the internet. Unfortunately though, when I was in high school, I wasn’t familiar with much beyond email.

That’s true – there have been some major changes recently. But I would assume the prep materials from one or two years ago should still work okay, right? And yeah, I know what you mean about finding resource online. Hopefully today’s students are able to track down the information they need.