Currently Browsing: Home Loans

When it involves borrowing a equity credit line then equity credit line comparison becomes important for people who wish to induce a very best deal. There area unit those that don’t hassle to enquire something a few equity credit line theme, they arbitrarily choose one bank and apply there to borrow a loan. Loan borrowed this manner is vulnerable and cause inconvenience to a recipient in future. Before a recipient truly borrows a loan he should make sure...

When it involves borrowing a equity credit line then equity credit line comparison becomes important for people who wish to induce a very best deal. There area unit those that don’t hassle to enquire something a few equity credit line theme, they arbitrarily choose one bank and apply there to borrow a loan. Loan borrowed this manner is vulnerable and cause inconvenience to a recipient in future. Before a recipient truly borrows a loan he should make sure...

The advantage of such consumer credit interest rates is that because it doesn’t rely upon the market trends and thence, once the interest rates goes higher within the market you won’t feel the pressure of the market as your consumer credit interest rates area unit fastened. As everyone is aware of that repaying of the house loan takes many years thus it’s terribly obligatory that you just do a probe to grasp your choices and measure the benefits and...

The advantage of such consumer credit interest rates is that because it doesn’t rely upon the market trends and thence, once the interest rates goes higher within the market you won’t feel the pressure of the market as your consumer credit interest rates area unit fastened. As everyone is aware of that repaying of the house loan takes many years thus it’s terribly obligatory that you just do a probe to grasp your choices and measure the benefits and...

What you need to consider in Home Loans? It is good to keep a level head and be realistic about what you can afford in buying a new home. Most of us want to have a new home and we need to lend money to finance our purchase. So, before you go to the purchasing process there is a need for you to find out how much you can borrow. Home loan is a loan advanced to a person to assist in buying a house or a condominium. Buying your own home is one of the most...

What you need to consider in Home Loans? It is good to keep a level head and be realistic about what you can afford in buying a new home. Most of us want to have a new home and we need to lend money to finance our purchase. So, before you go to the purchasing process there is a need for you to find out how much you can borrow. Home loan is a loan advanced to a person to assist in buying a house or a condominium. Buying your own home is one of the most...

High realty costs and high interest rates have forever created their call to require a home equity credit plunge tough. With new comes springing up close to their desired locations, they’re keen to require the plunge now, however are during a perplexity on whether or not this is able to be the correct time for a home equity credit. Manish and Parul aren’t the sole ones and nearly each home equity credit applier needs to form certain that they get the...

High realty costs and high interest rates have forever created their call to require a home equity credit plunge tough. With new comes springing up close to their desired locations, they’re keen to require the plunge now, however are during a perplexity on whether or not this is able to be the correct time for a home equity credit. Manish and Parul aren’t the sole ones and nearly each home equity credit applier needs to form certain that they get the...

Home loans are the foremost fashionable choice for prospective home patrons lately. With the quantity of operating, materialistic population increasing ever quickly in India, the quantity of formidable people longing for new, swank homes has conjointly up. However these swank homes return at a value, that the operating people tackle with the assistance of a consumer credit whereas banks approve a majority of the loan applications, they conjointly...

Home loans are the foremost fashionable choice for prospective home patrons lately. With the quantity of operating, materialistic population increasing ever quickly in India, the quantity of formidable people longing for new, swank homes has conjointly up. However these swank homes return at a value, that the operating people tackle with the assistance of a consumer credit whereas banks approve a majority of the loan applications, they conjointly...

Bad credit may end up owing to variety of reasons incomprehensible monthly payments, mastercard bills, or rent. although a nasty credit won’t have an effect on the day to day life, it will convince be a serious obstacle once a loan is applied for whether or not for a home, car, or loan. The great news is that home loans square measure currently out there even for individuals with a nasty credit history. Home loans for dangerous credit also are called Sub...

Bad credit may end up owing to variety of reasons incomprehensible monthly payments, mastercard bills, or rent. although a nasty credit won’t have an effect on the day to day life, it will convince be a serious obstacle once a loan is applied for whether or not for a home, car, or loan. The great news is that home loans square measure currently out there even for individuals with a nasty credit history. Home loans for dangerous credit also are called Sub...

What Is unhealthy Credit? In the home mortgage marketplace, unhealthy credit is outlined as any credit score below 680. Even people that don’t have any drawback obtaining smaller loans like automotive vehicle loans or personal loans can have a tough time obtaining a mortgage within the current monetary setting. that’s why it’s of the utmost importance to coach yourself concerning the state of the mortgage market nowadays and what it’s you would like to...

What Is unhealthy Credit? In the home mortgage marketplace, unhealthy credit is outlined as any credit score below 680. Even people that don’t have any drawback obtaining smaller loans like automotive vehicle loans or personal loans can have a tough time obtaining a mortgage within the current monetary setting. that’s why it’s of the utmost importance to coach yourself concerning the state of the mortgage market nowadays and what it’s you would like to...

If you have always dreamed of white picket fences and a golden retriever, you’ll be happy to know it’s possible to save up enough to buy a house in just 12 months depending on how disciplined you are. BB&T can help you set up the right accounts and give you all the right information when getting ready to save. In fact, there are certain techniques that anyone can use to stash cash for a future house payment so they can forget about apartment life and...

If you have always dreamed of white picket fences and a golden retriever, you’ll be happy to know it’s possible to save up enough to buy a house in just 12 months depending on how disciplined you are. BB&T can help you set up the right accounts and give you all the right information when getting ready to save. In fact, there are certain techniques that anyone can use to stash cash for a future house payment so they can forget about apartment life and...

For the longest time, homeowners can deduct the interest portion of their home mortgage payments from their taxable income. This is a serious tax deduction and provides a lot of tax relief to the typical American middle class household. Not only do you get to pay down the cost of buying your own home, you also save on your taxes. Unfortunately, if proposals being floated at the federal level pan out, the days of this gravy train might possibly end soon....

For the longest time, homeowners can deduct the interest portion of their home mortgage payments from their taxable income. This is a serious tax deduction and provides a lot of tax relief to the typical American middle class household. Not only do you get to pay down the cost of buying your own home, you also save on your taxes. Unfortunately, if proposals being floated at the federal level pan out, the days of this gravy train might possibly end soon....

Real estate is a risky business sector to invest your money in. But it can also be very profitable if done right. It is essential that you follow the following steps if you want to have a successful real estate investment career. Here are some basic facts on the real estate sector you should keep in mind. Research the property It is very important to have a complete idea about the property that you are planning to purchase. This will help you to...

Real estate is a risky business sector to invest your money in. But it can also be very profitable if done right. It is essential that you follow the following steps if you want to have a successful real estate investment career. Here are some basic facts on the real estate sector you should keep in mind. Research the property It is very important to have a complete idea about the property that you are planning to purchase. This will help you to...

Don’t Leave Any Stone Right Side Up Whereas Borrowing a Home Loan

Posted on Feb 3, 2018 in Home Loans | Comments Off on Don’t Leave Any Stone Right Side Up Whereas Borrowing a Home Loan

When it involves borrowing a equity credit line then equity credit line comparison becomes important for people who wish to induce a very best deal. There area unit those that don’t hassle to enquire something a few equity credit line theme, they arbitrarily choose one bank and apply there to borrow a loan. Loan borrowed this manner is vulnerable and cause inconvenience to a recipient in future. Before a recipient truly borrows a loan he should make sure...

When it involves borrowing a equity credit line then equity credit line comparison becomes important for people who wish to induce a very best deal. There area unit those that don’t hassle to enquire something a few equity credit line theme, they arbitrarily choose one bank and apply there to borrow a loan. Loan borrowed this manner is vulnerable and cause inconvenience to a recipient in future. Before a recipient truly borrows a loan he should make sure...

Notice Cheap Home Loan Interest Rates for Viable Dealing

Posted on Nov 16, 2017 in Home Loans | Comments Off on Notice Cheap Home Loan Interest Rates for Viable Dealing

The advantage of such consumer credit interest rates is that because it doesn’t rely upon the market trends and thence, once the interest rates goes higher within the market you won’t feel the pressure of the market as your consumer credit interest rates area unit fastened. As everyone is aware of that repaying of the house loan takes many years thus it’s terribly obligatory that you just do a probe to grasp your choices and measure the benefits and...

The advantage of such consumer credit interest rates is that because it doesn’t rely upon the market trends and thence, once the interest rates goes higher within the market you won’t feel the pressure of the market as your consumer credit interest rates area unit fastened. As everyone is aware of that repaying of the house loan takes many years thus it’s terribly obligatory that you just do a probe to grasp your choices and measure the benefits and...

What you need to consider in Home Loans?

Posted on Sep 13, 2017 in Home Loans | Comments Off on What you need to consider in Home Loans?

What you need to consider in Home Loans? It is good to keep a level head and be realistic about what you can afford in buying a new home. Most of us want to have a new home and we need to lend money to finance our purchase. So, before you go to the purchasing process there is a need for you to find out how much you can borrow. Home loan is a loan advanced to a person to assist in buying a house or a condominium. Buying your own home is one of the most...

What you need to consider in Home Loans? It is good to keep a level head and be realistic about what you can afford in buying a new home. Most of us want to have a new home and we need to lend money to finance our purchase. So, before you go to the purchasing process there is a need for you to find out how much you can borrow. Home loan is a loan advanced to a person to assist in buying a house or a condominium. Buying your own home is one of the most...

Good Time Home Loan

Posted on Jul 4, 2017 in Home Loans | Comments Off on Good Time Home Loan

High realty costs and high interest rates have forever created their call to require a home equity credit plunge tough. With new comes springing up close to their desired locations, they’re keen to require the plunge now, however are during a perplexity on whether or not this is able to be the correct time for a home equity credit. Manish and Parul aren’t the sole ones and nearly each home equity credit applier needs to form certain that they get the...

High realty costs and high interest rates have forever created their call to require a home equity credit plunge tough. With new comes springing up close to their desired locations, they’re keen to require the plunge now, however are during a perplexity on whether or not this is able to be the correct time for a home equity credit. Manish and Parul aren’t the sole ones and nearly each home equity credit applier needs to form certain that they get the...

Home Loan Information

Posted on May 27, 2017 in Home Loans | Comments Off on Home Loan Information

Home loans are the foremost fashionable choice for prospective home patrons lately. With the quantity of operating, materialistic population increasing ever quickly in India, the quantity of formidable people longing for new, swank homes has conjointly up. However these swank homes return at a value, that the operating people tackle with the assistance of a consumer credit whereas banks approve a majority of the loan applications, they conjointly...

Home loans are the foremost fashionable choice for prospective home patrons lately. With the quantity of operating, materialistic population increasing ever quickly in India, the quantity of formidable people longing for new, swank homes has conjointly up. However these swank homes return at a value, that the operating people tackle with the assistance of a consumer credit whereas banks approve a majority of the loan applications, they conjointly...

Home Loans For Bad Credit

Posted on Mar 14, 2017 in Home Loans | Comments Off on Home Loans For Bad Credit

Bad credit may end up owing to variety of reasons incomprehensible monthly payments, mastercard bills, or rent. although a nasty credit won’t have an effect on the day to day life, it will convince be a serious obstacle once a loan is applied for whether or not for a home, car, or loan. The great news is that home loans square measure currently out there even for individuals with a nasty credit history. Home loans for dangerous credit also are called Sub...

Bad credit may end up owing to variety of reasons incomprehensible monthly payments, mastercard bills, or rent. although a nasty credit won’t have an effect on the day to day life, it will convince be a serious obstacle once a loan is applied for whether or not for a home, car, or loan. The great news is that home loans square measure currently out there even for individuals with a nasty credit history. Home loans for dangerous credit also are called Sub...

Getting a Bad Credit Home Loan

Posted on Jan 1, 2017 in Home Loans | Comments Off on Getting a Bad Credit Home Loan

What Is unhealthy Credit? In the home mortgage marketplace, unhealthy credit is outlined as any credit score below 680. Even people that don’t have any drawback obtaining smaller loans like automotive vehicle loans or personal loans can have a tough time obtaining a mortgage within the current monetary setting. that’s why it’s of the utmost importance to coach yourself concerning the state of the mortgage market nowadays and what it’s you would like to...

What Is unhealthy Credit? In the home mortgage marketplace, unhealthy credit is outlined as any credit score below 680. Even people that don’t have any drawback obtaining smaller loans like automotive vehicle loans or personal loans can have a tough time obtaining a mortgage within the current monetary setting. that’s why it’s of the utmost importance to coach yourself concerning the state of the mortgage market nowadays and what it’s you would like to...

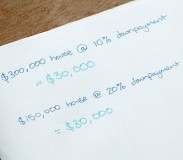

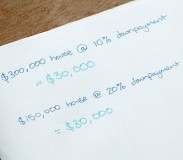

Contact 4 Ways to Save a House Deposit in Just 12 Months

Posted on Dec 23, 2016 in Home Loans | Comments Off on Contact 4 Ways to Save a House Deposit in Just 12 Months

If you have always dreamed of white picket fences and a golden retriever, you’ll be happy to know it’s possible to save up enough to buy a house in just 12 months depending on how disciplined you are. BB&T can help you set up the right accounts and give you all the right information when getting ready to save. In fact, there are certain techniques that anyone can use to stash cash for a future house payment so they can forget about apartment life and...

If you have always dreamed of white picket fences and a golden retriever, you’ll be happy to know it’s possible to save up enough to buy a house in just 12 months depending on how disciplined you are. BB&T can help you set up the right accounts and give you all the right information when getting ready to save. In fact, there are certain techniques that anyone can use to stash cash for a future house payment so they can forget about apartment life and...

Are You Ready For The Removal Of The Home Mortgage Deduction ?

Posted on Nov 26, 2016 in Home Loans | Comments Off on Are You Ready For The Removal Of The Home Mortgage Deduction ?

For the longest time, homeowners can deduct the interest portion of their home mortgage payments from their taxable income. This is a serious tax deduction and provides a lot of tax relief to the typical American middle class household. Not only do you get to pay down the cost of buying your own home, you also save on your taxes. Unfortunately, if proposals being floated at the federal level pan out, the days of this gravy train might possibly end soon....

For the longest time, homeowners can deduct the interest portion of their home mortgage payments from their taxable income. This is a serious tax deduction and provides a lot of tax relief to the typical American middle class household. Not only do you get to pay down the cost of buying your own home, you also save on your taxes. Unfortunately, if proposals being floated at the federal level pan out, the days of this gravy train might possibly end soon....

How To Have A Successful Real Estate Investment Career

Posted on Oct 17, 2016 in Home Loans | Comments Off on How To Have A Successful Real Estate Investment Career

Real estate is a risky business sector to invest your money in. But it can also be very profitable if done right. It is essential that you follow the following steps if you want to have a successful real estate investment career. Here are some basic facts on the real estate sector you should keep in mind. Research the property It is very important to have a complete idea about the property that you are planning to purchase. This will help you to...

Real estate is a risky business sector to invest your money in. But it can also be very profitable if done right. It is essential that you follow the following steps if you want to have a successful real estate investment career. Here are some basic facts on the real estate sector you should keep in mind. Research the property It is very important to have a complete idea about the property that you are planning to purchase. This will help you to...