Contact 4 Ways to Save a House Deposit in Just 12 Months

If you have always dreamed of white picket fences and a golden retriever, you’ll be happy to know it’s possible to save up enough to buy a house in just 12 months depending on how disciplined you are. BB&T can help you set up the right accounts and give you all the right information when getting ready to save.

In fact, there are certain techniques that anyone can use to stash cash for a future house payment so they can forget about apartment life and jump into home ownership.

Read on to discover 4 easy ways that you can save up a house deposit in as little as 12 months.

1. Figure out how much you need to save

Houses aren’t cheap and in light of the recent financial crisis, many lenders are saying goodbye to the zero down option. However, for first time buyers there are always FHA programs that allow you to buy with as little as 5%. Aim for that if this is your first house.

To determine how much you need, you’ll want to figure out what your maximum price point is. You can use online loan calculators to play around with figures and determine a monthly payment that you’re comfortable with. Remember that online loan calculators often don’t include your escrow payment which includes money for insurance and property taxes. Look at houses online for an idea of what property taxes are in your area.

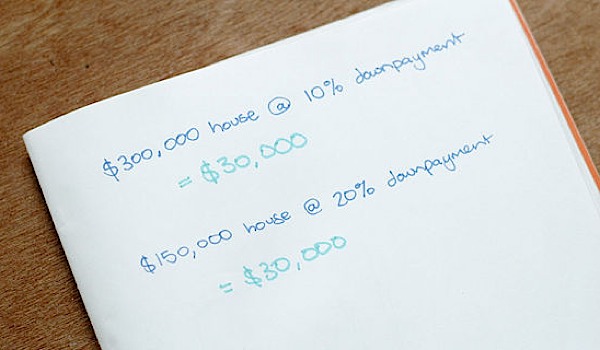

Next, take your maximum price point and multiply it by 5%. For example, if you’re comfortable with purchasing a home up to $200,000, you’ll need about $10,000 for a downpayment. Also include the cost of purchasing the property which can include a real estate lawyer, recording fees, etc.

2. Divide the amount from step 1 by your pay schedule

Your pay schedule is the amount of times you are paid each year. If you are paid weekly, you’ll get 52 paychecks each year. Biweekly, it’ll be 26 times.

If you need to save $10,000 and you get paid weekly, you would need to save $192.31 per week to reach your goal of $10,000 in a year. If you get paid biweekly, it would be $$384.62.

If this number is way too high or more than you make even, extend your deadline to 2 years or even 3 years. Find a goal that seems reasonable so you have better odds of sticking with it.

3. Save the money every single time you get paid

As soon as you get paid you need to put that money aside and DO NOT touch it. That’s the hardest part. It’s easy for things to come up and dipping into your house savings seems like a simple way to pay for your necessities, but resist doing so or you risk throwing off your savings plan.

4. Find ways to increase your income

Now that you know what you need to set aside to reach your goal, the next task is to find a way to live off of whatever is left. This may include increasing your income.

The easiest way to increase your income is to look for a better paying job. If you don’t want to do that or doubt that you can find a better paying job, you can get a second job or find a more creative way to make cash. If you have a special talent, you can leverage your skills online through freelancing sites or if you’re crafty, you can sell homemade creations for profits.

As always, cut unnecessary spending wherever possible and save, save, save. Move to a cheaper apartment, cut back on your TV plan, reduce your phone cots. If you look hard enough you’ll find ways to cut back and make your dream of home ownership possible.

With a little bit of hard work and some careful planning it’s possible to save for a house payment in just 12 months. However, if you need to, extend your deadline a short while and work to reach your ultimate goal of home ownership.